Request A Demo

Get a closer look at how we can help you engage with success.

Senior Living

According to data released by NIC MAP Vision cited by the National Investment Center for Seniors Housing & Care (NIC), seniors housing occupancy was unchanged from first to second quarter 2021, remaining at 78.7%.

Despite a flat average occupancy rate, a deeper look at the data suggests now is an even more favorable time for senior living communities to capitalize on current market opportunities. Here’s why:

Market Demand Is increasing

Move-ins are accelerating alongside consumer sentiment

Attane’s webinar on Senior Living Consumer Confidence & Sentiment also shows consumers are more confident in senior living and operators are seeing higher lead volume.

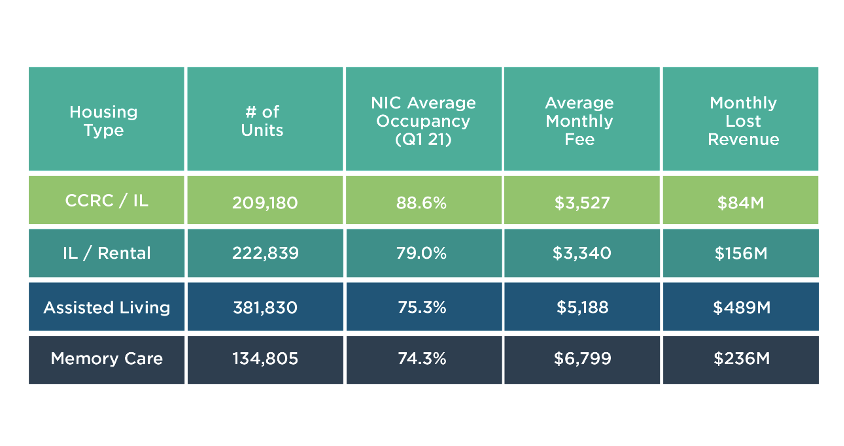

Now take these opportune market conditions into consideration when analyzing Q1’s unclaimed revenue table. In Q1 2021, total unclaimed revenue per month was $965 million. That’s at the same occupancy rate as Q2, but with less market demand and fewer move-ins than Q2.

But this unique moment we’re in, with a higher likelihood of move-ins and increased demand for senior living before competition has peaked, won’t last forever. Recovery in the industry that will be marked by stabilized occupancy and disappearing rent concessions isn’t a matter of if, but when.

To tap into the post-pandemic economic recovery and increase occupancy, two questions must be addressed:

Where should we prioritize investments to reclaim lost revenue? And what marketing tactics should we implement to gain an advantage over competition?

Let’s explore several ways to help your community determine its most lucrative revenue opportunities.

1. Lean into housing market demand before it stalls/normalizes — During 2020 and into 2021, the housing market saw record highs. In 2020, home prices soared and valuations were elevated, creating more wealth for sellers and an unprecedented rate of market growth. Median estimated home prices in the U.S. increased 8%, an actual increase in $19,940 from the start of 2020 across metro areas.

Housing demand in 2021 is still healthy due to various factors: Buyers who delayed purchasing during the pandemic, existing homeowners who require larger spaces to work remotely, and residents of multifamily buildings who seek a safe and less crowded space to live post-pandemic are several reasons.

For seniors, factors to sell could stem from increased valuations on their home; downsizing to find and meet friends in a safe and controlled community setting; and empty-nest syndrome, where a couple’s children move and home upkeep becomes too stressful. While home prices are still rising, they’re rising at lower rates. The pace of growth in May declined from April, which increased 17.2% year over year. To date, May was the first time the annual growth rate slowed in 13 months.

It’s hard to predict whether the housing market will continue at this pace or return to normal. That’s where education and honest conversations play key roles in the decision. Downsizing one’s home is never an easy topic to discuss, especially for seniors who have nostalgic memories tied to the address. Sales counselors who speak to prospects emotional concerns while also addressing the reality that home prices today may not have the same valuation in a year could be a viable way to overcome the objection of staying at home.

With the additional cashflow from selling and downsizing, prospective residents can see the benefits of senior housing being a viable and affordable alternative. When coupled with the socialization benefits of moving into a community setting and the availability of vaccines, selling a home becomes less daunting, especially considering the fast-paced growth of the market.

2. Regularly conduct strategic budgeting analysis to improve occupancy and profitability — It’s no secret senior housing experienced the lowest occupancy levels in years because of the pandemic. Dips in occupancy are less pronounced and extreme than in 2020, but it remains an issue providers must contend with. Even community models like entry-fee CCRCs/LPCs that are historically more insulated than other housing types are perceived as less attractive today to prospects than in 2019.

The results of the fourth edition of a survey conducted by architecture and design firm Perkins Eastman asked if the entry-fee CCRC/LPC model is endangered. Forty-four percent of respondents answered yes, while 56% of respondents said no. In the previous three iterations of the survey, a majority of respondents expressed that entry-fee CCRCs/LPCs are endangered. The results of the survey are promising but also underscore how much of an uphill battle community models have to accelerate occupancy. For example, 1Q 2021 occupancy for CCRCs/LPCs was 88.6% compared to 75.3% for AL and 74.3% for MC.

One way to enhance profitability, make strategic budgeting decisions, and find lost revenue is through calculating resident lifetime value (LTV). As a reminder, resident lifetime value projects the total revenue residents would bring to your community. Analyses like LTV help providers better utilize budgets while helping them prepare and anticipate dips in occupancy that can occur due to the rate of attrition, entrance fees, etc. This helps providers of various housing types maximize the average asking rent/fees to maximize the value of each unit to reduce lost revenue.

3. Double down on marketing investments to outperform competition and grow market share — A holistic omnichannel marketing campaign benefits senior housing in the present but pays dividends in the future. Take a cue from author and advertising executive Bruce Barton: “In good times, people want to advertise; in bad times, they have to.”

Nearly 100 years of historical data backs up this claim. Take Kellogg’s vs. Post cereal during the Great Depression as a pertinent example, evidenced by an article in Forbes magazine. Prior to the Great Depression, Post was the reigning leader in the dry cereal category. Once the Great Depression hit, Post substantially reduced its budget. Kellogg’s on the other hand, did the following:

Kellogg’s strategy paid off in the form of a 30% increase in profits, and the cereal became a household name that’s still recognized today and has maintained its place as the market leader above Post.

More recently, during the recession of 1990-91, fast food wars were being waged. When McDonald’s tapered its advertising and communication budgets, Taco Bell and Pizza Hut capitalized and doubled down. By seizing this opportunity, Pizza Hut increased sales 61%. Taco Bell also grew its sales 40% while increasing market share. McDonald’s on the other hand saw sales decline 28%.

The moral of the story: By reducing advertising budgets, your community makes itself susceptible to competition. Instead of waiting for the post-pandemic recovery, bring matters into your control. This requires proactively targeting prospective residents and effectively communicating with them. Garnering and increasing market share are there for the taking. Now’s the time to capitalize on revenue opportunities.

Learn Additional Ways to Reclaim Lost Revenue

Senior living marketing teams gain a competitive advantage by leveraging the tips and tactics shared here. Talk to a member of the Attane team for additional ideas on how to capitalize on the current market and maximize your revenue opportunity.

Get valuable insights delivered to your inbox